Do You Owe The AMT?

American educational reformer Horace Mann called education “the great equalizer.” In football, it’s been said that turnovers are the great equalizer. In taxes, there’s also an equalizer of sorts; it’s called the alternative minimum tax, or AMT. Instituted in 1969, it was intended to ensure that the very rich didn’t pay a lower effective tax rate than everyone else.1

In recent years, however, the “very rich” weren’t the only ones who needed to be concerned about the AMT. Because the AMT was not indexed for inflation until 2013, millions of middle-class Americans were being forced to pay it. Thanks to the Tax Cuts and Jobs Act of 2017, that number is falling, once again. Per the most recent data available, only 0.1% of taxpayers pay the AMT.1,2

What Is The AMT, Exactly?

It may be easiest to think of the AMT as a separate tax system with a unique set of rules for deductions, which are more restrictive than those in the traditional tax system.

The only way to know for sure if you qualify for the AMT is to fill out Form 6251 from the Internal Revenue Service. It may be worth doing just to be sure, especially if you are a high-income earner who can claim sizable tax breaks.

If you should have paid the AMT and the IRS discovers that you didn’t, you may owe back taxes and could also have to pay interest and/or penalties.

The AMT Language

Because the AMT system has complicated rules and provisions, it’s a good idea to consider consulting legal or tax professionals for specific information regarding your individual situation. And remember, the information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties.

If you want to avoid any potential surprises at tax time, it may make sense to know where you stand when it comes to the AMT. The time and energy you spend today may be worth the investment.

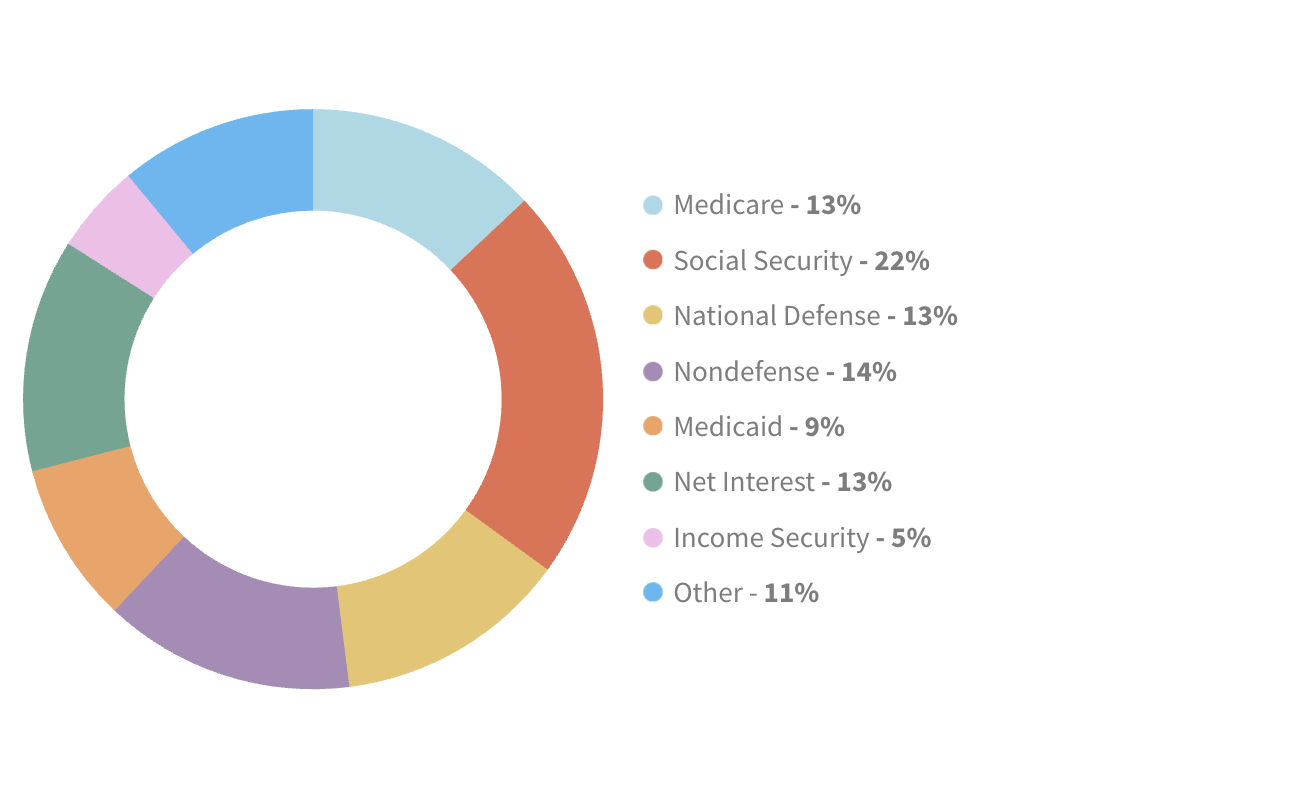

Where Does All That Money Go?

Here’s a breakdown of how the federal government spends its revenues.

Source: CBO.gov, March 20, 2025. Figures represent total outlays for the 2024 fiscal year, as reported by the Congressional Budget Office.

FAQs About the Alternative Minimum Tax (AMT)

-

The Alternative Minimum Tax (AMT) is a parallel tax system created to ensure that high-income earners pay at least a minimum amount of tax, even after taking deductions and credits. It recalculates your income using different rules that limit certain deductions available under the regular tax system.

-

The AMT was introduced in 1969 to prevent very wealthy taxpayers from using loopholes and deductions to avoid paying their fair share of taxes. Over time, because it wasn’t initially indexed for inflation, many middle-class taxpayers became subject to it as well.

-

Since the Tax Cuts and Jobs Act of 2017, far fewer people are affected by the AMT. As of the most recent data, only about 0.1% of taxpayers pay it. Generally, high-income earners who claim large deductions are the ones most likely to be subject to the AMT.

-

You can determine whether you owe the AMT by completing IRS Form 6251. This form calculates your income using AMT rules and compares it to your regular tax liability. If your AMT amount is higher, you must pay the difference.

-

The AMT disallows or limits several deductions that are allowed under the regular tax system, such as state and local tax deductions, miscellaneous itemized deductions, and certain medical expenses. This is why high-income taxpayers often see a higher liability under AMT rules.

-

Yes. The AMT was not indexed for inflation until 2013, which caused many middle-income taxpayers to fall under its scope. Since then—and especially after the 2017 tax reform—the AMT has been adjusted for inflation each year, reducing its reach.

-

Working with a qualified tax or financial advisor can help you evaluate whether you’re at risk of triggering the AMT. Regular tax planning can identify deductions or income sources that might push you into AMT territory and help you make adjustments before filing.

1. Investopedia.com, February 26, 2025

2. TaxPolicyCenter.org, August 12, 2025

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2025 FMG Suite.

© 2025 Commonwealth Financial Network®